Technical Insights - January 2023

We highlight some key tips and considerations for clients unsure of whether to live in, rent out or sell an inherited property.

What’s new from 1 January 2023

Downsizer eligibility age is 55 from 1 January 2023 and applies to downsizer contributions made after this date.

Residents entering residential aged care will incur the following maximum permissible interest rate based on their date of entry:

1/01/2023 to 31/03/2023 - 7.06%

1/10/2022 to31/12/2022 – 6.31%

The work bonus income bank (the maximum amount of unused work bonus amounts that can accrue and be used against future income) temporarily increased to $11,800 and applies from 1 December 2022 to 31 December 2023.

The Australian Securities and Investments Commission (ASIC) has said that financial planners can advise on the Home Equity Access Scheme without needing a credit licence, as the loan is not deemed to be a credit contract.

Common questions on inheriting property

With the mean price of a residential dwelling in Australia now $944,000*, inheriting a property can represent a significant boost of wealth for clients. Deciding what to do with inherited property can be overwhelming so it’s worthwhile to carefully walk through all the options. In this article, we highlight some key tips and considerations for clients unsure of whether to live in, rent out or sell an inherited property.

Can I buy out my siblings and keep the property?

Where multiple beneficiaries, often siblings, inherit a property and one sibling wants to keep the property when others want to sell and receive equivalent cash payments, it can be a tricky situation to navigate and often requires legal advice.

While one cannot change the specific wording of a Will, it may be possible to vary the way assets of the estate that are distributed amongst beneficiaries. If all the beneficiaries are over the age of 18 years and have full legal capacity, they may be able to agree to alter the terms of the Will to cater for this. The agreement between the beneficiaries can then be formalised by way of a Deed of Family Agreement.

It is possible for your client to buy out their siblings’ share of the property subject to financing. Your client can use available savings to buy out their siblings, or source financing from a lender.

In most cases, traditional lenders won’t provide a loan for a property in an estate or trust with other owners. Clients may be able to find a money lender for estate funding, these types of loans are also known as probate loans or inheritance loans.

Practically, the lender pays the money directly to the estate, which will then go to the beneficiaries who are selling their share in the property. Your client who wants to keep the house will assume the loan and pay the lender. Interest rates are usually higher than with a bank, but clients are usually able to get approval quickly so they can move forward with the buyout. Clients will need to bring some cash to the table because most inheritance loans are only for as much as 70 percent of the value of the property. The lender will review the application and determine how much percentage of funds to provide and the terms for the loan.

After the refinancing is complete, the title of the property will go to your client who is buying the rest of the property from their siblings. They have the option of getting a refinanced loan from a bank for a lower interest rate.

If the above is not applicable to your clients, they could set up a private arrangement with their siblings. Clients should seek legal advice to establish a contract which spells out how much they would be paying for the other share of the property and the interest rate, monthly payments and how long until the property is paid off, whether the other person can foreclose if repayments are not made etc.

*Australian Bureau of Statistics, Total Value of Dwellings – Reference period September Quarter 2022.

What are the capital gains tax (CGT) consequences?

According to the Australian Taxation Office (ATO), there are certain rules and exemptions that apply depending on whether clients are selling property that was used as a main residence (such as the main residence exemption) or property that was used as an investment to generate income.

If clients are selling an inherited property from a deceased estate, certain special CGT rules are relevant. Whether CGT is applicable depends on the following factors:

when the deceased acquired the property,

how the deceased used the property while they owned it i.e. was it the deceased’s main residence or was it used to produce income,

the deceased’s date of death, and

whether your client was an Australian resident when they sold the inherited property.

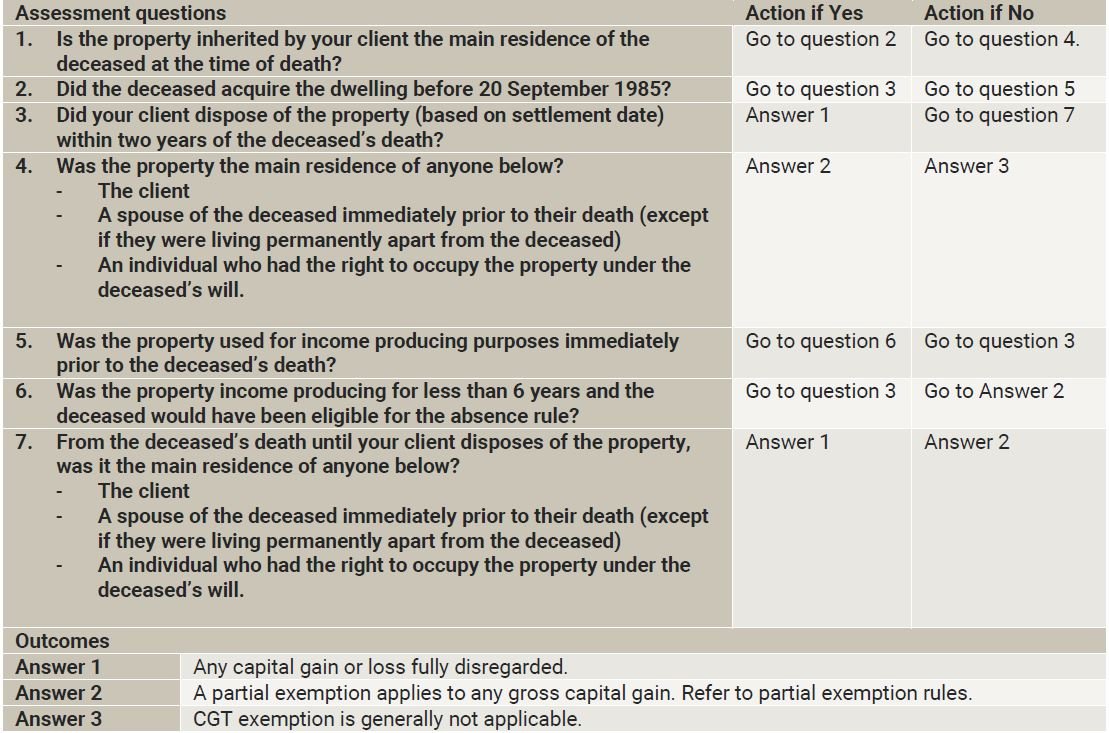

If the property inherited was the main residence of the deceased, a CGT exemption may apply according to the table below.

Partial exemption rules**

If clients do not qualify for a full exemption from capital gains tax (CGT) for an inherited property, they may be entitled to a partial exemption using the following steps:

Step 1: Calculate the capital gain or loss from selling or disposing of the property.

Step 2: Multiply the amount at step 1 by the number of non-main residence days

Step 3: Divide the amount at step 2 by the total days

Non-main residence days

Generally, non-main residence days is the total of:

1. The number of days, from when the deceased died until settlement of the sale of the property, that it was not the main residence of one of the following:

client, as a beneficiary, if they disposed of the property as a beneficiary

a person who was the spouse of the deceased (except if they were permanently separated)

an individual who had a right to occupy the property under the deceased's will.

2. The number of days during the deceased's ownership of the property that it was not their main residence.

However, clients do not include item 2 (the number of non-main residence days during the deceased's ownership) if either of the following happened:

the deceased acquired the property before 20 September 1985

the property passed to you after 20 August 1996, and just before the deceased died, the property:

was the deceased's main residence

was not being used to produce income.

A further adjustment may be required if the property was a main residence but part of it was rented out or used as a place of business.

Total days

If the deceased acquired the property:

before 20 September 1985, 'total days' is the number of days from their death until a client disposed of the property

on or after 20 September 1985, 'total days' is the number of days from when the deceased acquired the property until clients disposed of it.

If clients dispose of the property within 2 years of the deceased's death, they can ignore the main residence days and total days during their period of ownership.

**ATO, Calculating a partial exemption for inherited property

Do inherited real estate assets form part of the marital asset pool in the event of divorce/relationship breakdown?

Generally, an inheritance is not automatically quarantined from the asset pool following the breakdown of a relationship. That is not to say, however, that an inheritance will always form part of the parties’ asset pool in all circumstances. Inheritances received by one of the parties to a relationship is considered on a case-by-case basis by the family courts.

Whilst the Court may exclude an inheritance from the marital asset pool, it can still take the inheritance into consideration as a financial resource of one of the parties. Meaning, the Court may not make an adjustment to the marital asset pool in favour of one party for their ‘future needs’ if they have very recently received a significant inheritance.

One option is to enter into a financial agreement whereby each party agrees not to make a claim against any inheritance received by the other party in the future.

A financial agreement is made under the Family Law Act 1975 (Cth) which is effectively a contract between the parties which ousts the Family Court’s jurisdiction to deal with property matters. When entering into a binding financial agreement, it is a requirement for each party to retain their own lawyer to advise them as to the advantages and disadvantages of entering into such an agreement.

Are there any other considerations I should be aware of?

Inheriting real property in Australia has a lot of benefits, but it also comes with responsibility and financial liability. If clients are thinking to retain an inherited property beyond the 2 year mark or turning it into an investment property, keep in mind some of the following:

Advantages:

Owning a property - with the prices of homes on the increase all over Australia, it is not easy to get into the property market.

A start in property investment portfolio - if clients plan to use the inherited property as an investment that means they’ve got a head start in their property investment portfolio.

New income stream - if they’ve inherited a property that’s been paid off and turn it into an investment, they’re looking at a fresh income stream.

Exemptions from CGT - if they sell an inherited property within 2 years of inheriting, they’re looking at a decent pay out as there may be no CGT.

Potential growth - if clients hold onto an inherited property and sell later, they’ll no longer be exempt from CGT. However, the value of the property will likely increase so they could be looking at greater capital growth overall.

If the asset is business real property – they can transfer it into a self-managed super fund (subject to contribution caps) and generate tax effective earnings.

Disadvantages:

Property management - managing an investment property needs work and funds. The first steps will be fixing any property damage, sorting out property insurance and making a target market determination.

Loss of pension benefits - depending on the value of the inherited asset and when they receive it, they could lose some or all of their pension benefits whether they keep it vacant, rented or sell it.

Properties with debt - if inheriting a property in Australia that hasn’t been refinanced yet and clients cannot pay off the mortgage, the bank may not release the property. A testator can get around this by nominating the executor to pay off all debts before the execution of the will.

Important information

Disclaimer: The information provided is current as at 25 January 2023 and is subject to change. This article is not cliental financial, taxation or legal advice and should not be relied on as such. Any advice in this document is general advice only and does not consider the objectives, financial situation or needs of any client. You should obtain specialist financial, taxation or legal advice relevant to your circumstances before making investment decisions. Whilst every care has been taken in the preparation of this information, Australian Unity Cliental Financial Services Ltd (‘AUPFS’) does not guarantee the accuracy or completeness of it. Where an article is provided by a third party any views in that article are the views of the author and not of AUPFS. AUPFS does not guarantee any outcome or future performance. Australian Unity Cliental Financial Services Ltd ABN 26 098 725 145, AFSL No. 234459. This document produced in January 2023.