Budget 2023-24 | Special Report

Key Findings

From July 1, 2026, employers must make super guarantee payments on the same day they pay employees.

From July 1, 2025, earnings on any portion of a person’s total super balance over $3 million will be taxed at 30%.

The Medicare levy low-income thresholds will be increased from July 1, 2022, for singles, families, seniors and pensioners.

Eligible lump sum payments in arrears will be exempted from the Medicare levy from July 1, 2024.

Increased support for people, including an increase in the base rate of working age and student payments by $40 per fortnight.

Special Report | May 2023

In his second budget since winning power in May last year, Treasurer Jim Chalmers boasted the first budget surplus in 15 years as strong jobs growth and high mining revenue swelled its coffers. The Treasurer announced a package of cost-of-living measures, including up to $3 bn in energy bill relief (expected to reduce power bills by up to $500 for 5 million households) and $1.3bn for home energy upgrades.

After several interest rate rises and calls to use fiscal policy to help fight inflation, Chalmers said the budget aimed to “strike a considered, methodical balance … between spending restraint to keep the pressure off inflation, while doing what we can to help people struggling to make ends meet”.

Broadly, the Budget included measures that*:

Provide cost-of-living relief that is responsible and affordable and prioritises those most in need.

Deliver historic investments in Medicare and the care economy – making it easier and cheaper for Australians to see their doctor.

Broaden opportunity by breaking down the barriers of disadvantage and exclusion.

Lay the foundations for growth by embracing clean energy, and investing in value-adding industries, people, skills, technology and small business.

And strengthen the Budget – with a surplus forecast for this year, with less debt and smaller deficits compared with recent budgets.

It is important to note the Budget announcements are still only proposed at this stage and to be legislated. Changes can also be made prior to these proposals becoming law.

What isn’t in the budget

Personal income tax rates unchanged for 2023-24; Stage 3 start from 2024-25 unchanged.

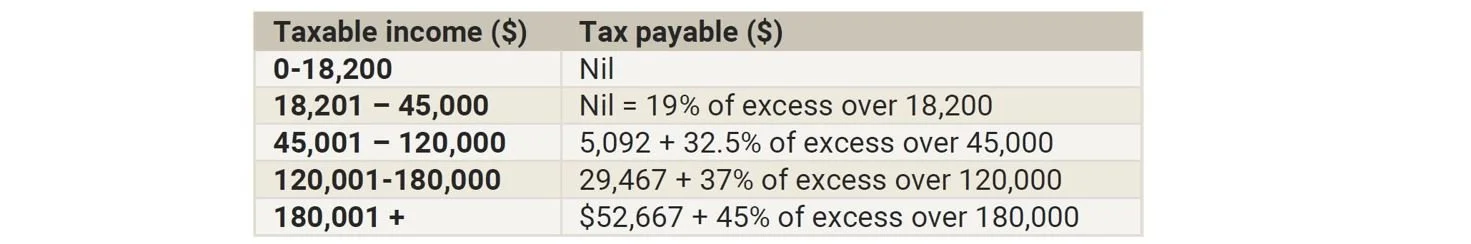

The 2023-24 tax rates and income thresholds for residents (unchanged since 2022-23) are:

The Budget did not announce any changes to the State 3 personal income tax cuts that are set to commence from 1 July 2024. Under the stage 3 changes from 1 July 2024, as previously legislated, the 32.5% marginal tax rate will be cut to 30% for one big tax bracket between $45,000 and $200,000. The 37% tax bracket will be entirely abolished at this time.

Low income tax offset for 2023-24 unchanged

Superannuation pensions: No reduction in minimum drawdowns for 2023-24.

The Budget did not announce a further extension to 2023-24 of the temporary 50% reduction in the minimum annual payment amounts for superannuation pension and annuities. The 50% reduction in the minimum pension payment which applied since 2019-20 is set to end on 30 June 2023.

*Budget Speech 2023–24, www.treasury.gov.au

Superannuation

Employers to pay super on payday

From 1 July 2026, employers are required to make super guarantee payments on the same day they pay employees. Referred to as ‘payday’ super, this measure aims to make it easier for businesses to manage their payrolls and reduce their accounting liabilities.

As part of this measure, the Government is also improving data matching capabilities to identify and act on cases of SG underpayment by employers.

This measure benefits lower paid, casual and insecure workers who are more likely to miss out when super is paid less frequently.

Amending the Non-arm’s length Income (NALI) provision

The Government will amend the non-arm’s length income (NALI) provisions which apply to expenditures incurred by superannuation funds by:

Limiting income of SMSF and small APRA funds that are taxable as NALI to twice the level of a general expense. Additionally, fund income taxable as NALI will exclude contributions

Exempt large APRA regulated funds from the NALI provisions for both general and specific expenses of the fund

Exempt expenditure that occurred prior to the 2018-19 income year.

Background

Currently, under ATO’s LCR 2021/2, NALE of a “general nature” (e.g. accounting fees, audit fees, investment adviser fees, etc) may still have a sufficient nexus to all of the income of a fund. As a result, if an SMSF incurs a small fund expense that is not on arm’s length terms, all of the income derived by the fund (including taxable contributions and capital gains) could be taxed at 45%. The Budget changes propose to limit the income taxable at 45% as NALI to twice the level of a such general expenses.

Reduced super concessions on total super balances over $3m

From 1 July 2025, any portion of a person’s total super balance over $3m will have earnings taxed at 30 per cent. Total super balances under $3m continue to receive 15 per cent earnings tax. Holdings in retirement phase continue to receive nil tax.

Interests in defined benefit schemes will also have an appropriate value and have earnings taxed under this measure to ensure these products are treated similarly.

Tax

Increasing the Medicare Levy low-income threshold

The Government will increase the Medicare levy low-income thresholds for singles, families and seniors and pensioners from 1 July 2022. The increase in thresholds means more low income individuals can be exempt from paying the Medicare Levy.

Medicare lower income thresholds

Medicare levy exemption for lump sum payments in arrears from 1 July 2024

The Government will exempt eligible lump sum payments in arrears from the Medicare levy from 1 July 2024. The measure seeks to ensure low-income taxpayers do not pay higher amounts of the result of receiving an eligible lump sum payment, e.g. as compensation for underpaid wages.

Small Business Support - $20,000 instant asset write-off

From 1 July 2023 until 30 June 2024, the Government will improve cash flow and reduce compliance costs for small businesses by temporarily increasing the instant asset write-off threshold to $20,000.

The instant asset write-off rules allow for the immediate deduction for the cost of a depreciating asset for small business entities. However, those rules were effectively replaced by temporary full expensing in relation to depreciating assets first held and used or installed ready for use for taxable purposes, between the 2020 Budget time and 30 June 2023. Without this proposal, the instant asset threshold goes back to $1,000.

Under this proposal, small businesses, with aggregated annual turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets.

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first year and 30% each income year thereafter.

The provision that prevents small businesses from re-entering the simplified depreciation regime for 5 years if they opt-out will continue to be suspended until 30 June 2024.

Small business energy incentive

Small and medium businesses, with aggregated annual turnover of less than $50 million, will be able to deduct an additional 20 per cent of the cost of eligible depreciating assets that support electrification and more efficient use of energy. Up to $100,000 of total expenditure will be eligible for the Small Business Energy Incentive, with the maximum bonus deduction being $20,000.

Eligible assets will need to be first used or installed ready for use between 1 July 2023 and 30 June 2024. Eligible upgrades will also need to be made in this period.

A range of depreciating assets, as well as upgrades to existing assets, will be eligible for the Small Business Energy Incentive. These will include:

assets that upgrade to more efficient electrical goods such as energy-efficient fridges,

assets that support electrification such as heat pumps and electric heating or cooling systems, and

demand management assets such as batteries or thermal energy storage.

Full details of eligibility criteria will be finalised in consultation with stakeholders. Certain exclusions will apply such as electric vehicles, renewable electricity generation assets, capital works, and assets that are not connected to the electricity grid and use fossil fuels.

Expanding Part IVA

The Government is expanding the scope of the general anti-avoidance rule for income tax (Part IVA of the Income Tax Assessment Act 1936) so that it can apply to:

schemes that reduce tax paid in Australia by accessing a lower withholding tax rate on income paid to foreign residents

schemes that achieve an Australian income tax benefit, even where the dominant purpose was to reduce foreign income tax.

This measure will apply to income years commencing on or after 1 July 2024, regardless of whether the scheme was entered into before that date.

FBT rules for Electric Vehicles: Rules for plug-in hybrids to sunset

The Government will sunset the eligibility of plug-in hybrid electric cars from the FBT exemption for eligible electric cars. This change will apply from 1 April 2025.

Arrangements entered into between 1 July 2022 and 31 March 2025 remain eligible for the Electric Car Discount.

Social security

Administration of emergency response payments

Services Australia will receive funding that enables it to respond to natural disaster events, including the delivery of the Australian Government Disaster Recovery Payment and Disaster Recovery Allowance.

Increases to payments

Over 5 years from 2022-23, increased support will be provided for people. This includes:

Increasing the base rate of working age and student payments by $40 per fortnight. This increase applies to the JobSeeker Payment, Youth Allowance, Parenting Payment (Partnered), Austudy, ABSTUDY, Disability Support Pension (Youth), and Special Benefit. It will commence on 20 September 2023 when payment rates index.

This measure does not include JobSeeker Payment single principal carers of a dependent child exempted from mutual obligation requirements for the following reasons - foster caring, non-parent relative caring (court order), home schooling, distance education, or large family.

Extending eligibility for the existing higher single JobSeeker Payment rate for recipients aged 60 years and over to recipients aged 55 years and over who are on the payment for 9 or more continuous months.

The new rates will commence from 20 September 2023, subject to the passage of legislation. Indexation of eligible payment rates will also take place as usual on 20 September.

Increase to rent assistance

Over 5 years starting from 20 September 2023, the government will increase the maximum rates of Rent assistance by 15 per cent to help rental affordability challenges. The maximum Rent Assistance for a single person is currently $157.20 pf and varies depending on the amount of rent paid and the family situation of the person.

Work bonus bank top up extended

Set to expire on 30 June 2023, the additional $4,000 that has been added to a pensioner’s work bonus bank has been extended to 31 December 2023. Pensioners can earn up to $11,800 ($7,800 standard work bonus bank plus $4,000 top up) before their pension is reduced. From 1 January 2024, the work bonus bank reduces to the standard $7,800 per annum.

Parenting payment (Single) improved

Over 5 years from 2022-23, the Government will extend eligibility for Parenting Payment (Single) to single principal carers with a youngest child under 14 years (up from 8 years).

This measure will move those who are single principal carers of a dependant child aged under 14 years and currently on the JobSeeker Payment ($745.20 pf) to the Parenting Payment (Single) rate of $922.10 fp, this will result in an increase of $176.90 pf. They will also receive the basic Pension Supplement of $27.20 pf that is available to Parenting Payment (Single) Recipients.

Aged care

Aged Care regulatory reform

Additional funding is being provided over five years from 2022-23 to implement recommendations from the Royal Commission into Aged Care Quality and Safety initiatives to strengthen the regulation of the aged care sector and improve the health and safety of older Australians receiving aged care. Funding includes:

Enhancements to the Star Rating system,

A stronger Aged Care Regulatory Framework to support the new Aged Care Act due to commence from 1 July 2024,

Establishing a national worker screening and registration scheme from 1 July 2024,

Improvements to food and nutrition in aged care through the development, monitoring and enforcement of food and nutritional standards.

Improved age care support

Over five years from 2022-23, additional funding will be provided to continue improving the delivery of aged care services and respond to the Report of the Royal Commission into Aged Care Quality and Safety. Funding includes:

Extending and make ongoing, the Disability Support for Older Australians Program, and

A new General Practice in Aged Care incentive payment to improve general practitioner attendance and continuity of care in residential aged care homes, and to reduce avoidable hospitalisations

Home care reforms

From 1 July 2023, additional home care funding will be allocated, including:

9,500 additional home care packages,

Establishment of a single aged care assessment system, and

Additional funding for the Independent Health and Aged Care Pricing Authority to undertaking pricing and costing research activities.

Frontline workers to receive pay rises

Over 5 years from 2022-23, the Government is increasing award wages by 15 per cent from 30 June 2023 for many aged care workers.

Enrolled nurses, assistants in nursing, personal care workers, head chefs and cooks, recreational activities officers (lifestyle workers) and home care workers all secure a historic increase to their award wages:

A registered nurse on a level 2.3 award wage will be paid an additional $196.08 a week (more than $10,000 a year)

An enrolled nurse on a level 2 award wage will be paid an additional $145.54 a week (more than $7500 a year)

An assistant in nursing on a level 3 award wage will be paid an additional $136.68 a week (more than $7100 a year)

A personal care worker on a level 4 (aged care award) or a home care worker on a level 3.1 (SCHADS award) will be paid an additional $141.10 a week (more than $7300 a year)

A recreational activity officer on a level 3 (aged care award) will be paid an additional $139.54 a week (more than $7200 a year)

A head chef/cook on a level 4 (aged care award) will be paid an additional $141.12 a week (more than $7300 a year)

A staff member with a Certificate III qualification moves from earning only $940 per week to $1,082.

Reducing the number of people under age 65 in aged care

Over 3 years from 2023-24, a package of initiatives aim to reduce the number of people living in residential aged care under age 65. Funding includes:

Targeted education and training packages for General Practitioners, clinical staff, social workers, carers, advocates, families, and other organisations and people that support and influence the decision making of younger people in residential aged care.

Establishing a central function in the Department of Health and Aged Care to support nationally consistent decision making on the eligibility of younger people seeking to enter residential aged care.

An evaluation of actions already taken by governments to reduce the number of younger people in residential aged care, to inform future initiatives.

Other measures

Energy bill relief

The Government is partnering with state and territory governments to deliver up to $3 billion of electricity bill relief for eligible households. From July 2023, this plan will deliver up to $500 in electricity bill relief for eligible households, and up to $650 for eligible small businesses.

Eligible householder include:

Pensioners,

Commonwealth Seniors Health Card holders,

Family Tax Benefit A and B recipients and

Small business customers of electricity retailers.

National Disability Insurance Scheme (NDIS) effectiveness and sustainability

Focused on sustainability, the government will provide funding over 4 years from 2022-23 to support participant outcomes. Funding includes:

Investment in capability and systems, to improve processes and planning decisions.

Better support to help participants manage their plan within budget.

Using a lifetime approach to ensure plans are more transparent and flexible for life events.

Support for independent living decisions

Improvements in the ability to detect, respond to and reduce fraud and non-compliant payments.

Supporting the quality and effectiveness of services provided to participants through improved oversight of services and increasing the take up of evidence-based supports.

Trialling blended payment models to increase incentives for providers to innovate service delivery and improve outcomes.

Partner with communities to pilot

Support for Children and New and Expecting Parents

From 2023-24, additional funding will help parents support their children’s health and early development. Funding includes:

continued support for the Australian Breastfeeding Association’s National Breastfeeding Helpline

extended funding for Foetal Alcohol Spectrum Disorder prevention, diagnosis and support activities

continued activities that address declines in childhood immunisation rates for children at 5 years and under

Increasing supply of social and affordable housing and making it easier to buy a home

The government intends to expand the eligibility of the Home Guarantee Scheme from 1 July 2023 to:

allow any 2 eligible people to be joint applicants for a guarantee beyond spouses and de facto partners

allow non-first home buyers who have not owned a property in Australia for at least 10 years to access the First Home Guarantee and Regional Home Guarantee

allow a single legal guardian of children to access the Family Home Guarantee

allow Australian permanent residents to access the Scheme

Reduced managed investment trust withholding tax on build-to-rent properties

Starting from 1 July 2024 (subject to consultation), reduced managed investment trust withholding tax will apply on newly constructed build-to-rent properties.

Designed to increase the supply of housing, for eligible new build-to-rent construction projects consisting of 50 or part apartments that commence after Budget night, the Government will:

increase the rate for the capital works tax deduction (depreciation) to 4% per year;

reduce the final withholding tax rate on eligible fund payments from managed investment trust (MIT) investments from 30% to 15%.

The dwellings must be retained under single ownership for at least 10 years before being able to be sold and landlords must offer a lease term of at least 3 years for each dwelling.

Disclaimer

The information provided is current as at 9 May 2023 and is subject to change. This article is not personal financial, taxation or legal advice and should not be relied on as such. Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain specialist financial, taxation or legal advice relevant to your circumstances before making investment decisions. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd (‘AUPFS’) does not guarantee the accuracy or completeness of it. Where an article is provided by a third party any views in that article are the views of the author and not of AUPFS. AUPFS does not guarantee any particular outcome or future performance. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL No. 234459. This document produced in May 2023. ©