Coppleson: Why the New Bull Market Could Start as soon as March 2023

Article written by Richard Coppleson (5th December 2022)

Original article can be accessed here

In the last week, US and Australian markets have rallied. The US Federal Reserve has indicated the next rate hike will be less than the past four, while we’re also moving into ‘Santa rally’ season. The bears may be watching this with frustration but it’s an expected (and temporary outcome). The bear market is not over yet. The worst is likely still ahead of us.

The good news is that I expect the bull market to return in March 2023. History would suggest so.

So here’s a look at what’s happening now and why I think the new bull market will start in March 2023.

Markets are rallying in the lead to Christmas

The S&P 500 went below its 200-day moving average in April and has spent the last 8 months moving further down. Last week that all changed.

I believe the rally will extend. Those with shorts and long cash may be forced into covering those positions. I also think that some will add to their long positions (but be forced to dump these in January and February).

The ASX200 followed the path of its US counterpart.

There are a couple of key reasons behind this rally.

The US Federal Reserve signalled that the next hike would be 50bps rather than the 75bps of the past four consecutive meetings. The market responded positively to this.

December is traditionally a strong month. This is part of a trend known as the Santa rally.

I view this as a bear market rally rather than a return to a bull market.

The market is likely to be hit with US recession fears at the start of 2023 which will carry through the first quarter of the year. There is also typically a sector rotation at the start of the year which will hit prices. I expect a number of US companies will lower their EPS forecasts in February and March ahead of the April reporting season in the US. This will see stocks hit lows. It will be a combination of poor outlook and lower EPS forecasts – a time when investors will feel it is ridiculous to be buying. I think hindsight will end up proving otherwise. The rate of Federal Reserve rate hikes will play a role here.

Banking on a slowdown in US rate hikes

The US Federal Funds rate is currently 4.0%, the highest it has been since January 2008. Markets expect the Federal Reserve to increase by 0.5% in its next meeting which would leave the rate at 4.5% at the end of 2022.

If this is the case, the Federal Reserve has increased the Federal Funds rate:

by 425 basis points in 2022,

well ahead of the 250 basis point increase in 1994,

even above the 400 basis points in each 1979 and 1980.

In its next decision, the Federal Reserve will be relying on two more monthly inflation reports and the non-farm payroll report from last Friday.

Based on US futures, the market has priced a 50bps change in December and another 50bps in February 2023 and then a pause in hike.

What this all means is that we could see a lot of market pain in the start of the year, with a low in mid-March. Where things could get really interesting is looking at when the US Federal Reserve might pivot and make a rate cut.

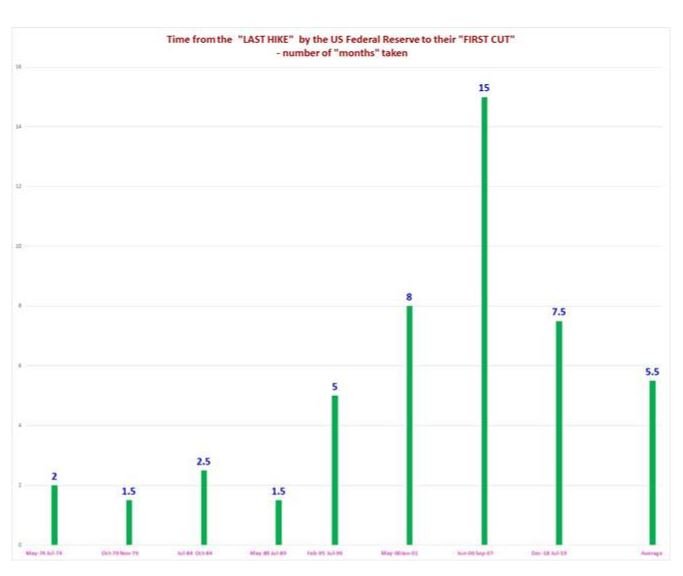

I found eight distinct Federal Reserve hike cycles. The average time to the first cut post the last hike was 5.5 months. Though in the last 30 years, the average time has been about nine months.

Based on history, you might expect the first rate cut to come in December 2023. There’s a high probability of a recession in the US in 2023 though, so we might see a cut earlier in September.

If you discount that back by 6-8 months, it dates to March 2023, meaning that we may see a bull market start from then. The bear market will have been tracking for around 15 months by then or 477 days – a decent run. This is longer than average too. The average bear market since 1929 has run for 308 days.

Around September 2023, we’ll have a better indication of whether a rate cut will be happening or likely to happen soon and the market will be looking for the green shoots. Just as it did in late 2003, I expect we’ll start to see more obvious signs of recovery, there will be big EPS upgrades and expensive PEs will come down.

This also reflects how the S&P 500 has typically behaved post a final rate hike. You can see this in the chart below.

Of course, if the US has a hard recession, the timing for this will need to push out by around 6 months, but otherwise this all means March 2023 will be the final market low.

History never repeats

But as they say, it often rhymes. The patterns of the past suggest we’re coming close to the end of the current rate rise cycle and the bear market. If March 2023 becomes the final market low, and the start of the bull market run, investors may find opportunities there. They’ll need to have a strong stomach though. The evidence for a change will take time to appear. Bear markets don’t last forever after all.

Get more insights from the insto desk in the Coppo report

This article is an excerpt from The Coppo Report contributed to Livewire by Richard Coppleson, Director - Institutional Sales and Trading, Bell Potter. You can find out more here.

You can also stay up to date with the latest news by hitting the ‘follow’ button and you’ll be notified every time I post a wire.